Maximize Your Satisfaction With the Right Vehicle Insurance Coverage Plan

Browsing the intricacies of vehicle insurance can typically feel overwhelming, yet it is necessary for guaranteeing your tranquility of mind on the roadway. The most reliable approaches for customizing your vehicle insurance plan may not be immediately apparent-- this discussion will uncover important insights that could change your strategy to insurance coverage.

Recognizing Vehicle Insurance Policy Essentials

Recognizing the basics of car insurance coverage is vital for each car owner. Vehicle insurance policy works as a monetary safeguard, protecting people from possible losses arising from accidents, theft, or damage to their automobiles. At its core, automobile insurance coverage is comprised of various protection types, each developed to address details dangers and obligations.

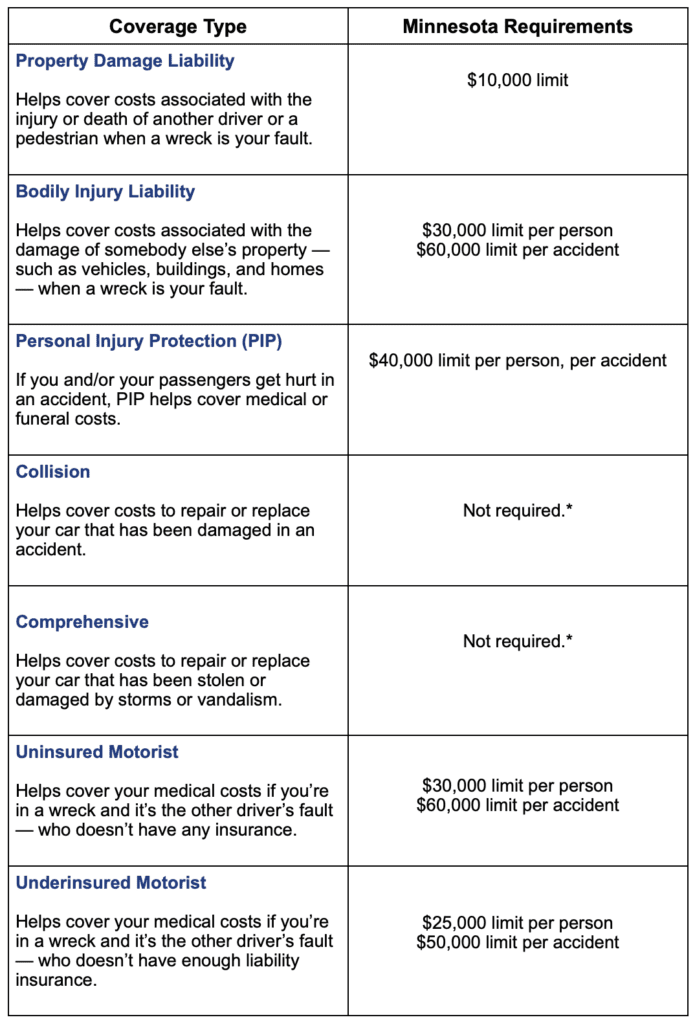

The key elements consist of obligation coverage, which safeguards versus problems caused on others in an accident; crash protection, which pays for fixings to your lorry after an accident; and comprehensive insurance coverage, which covers non-collision-related events such as burglary or all-natural disasters. In addition, numerous plans provide personal injury defense (PIP) or uninsured/underinsured driver insurance coverage, which can offer essential assistance in case of a crash with an at-fault chauffeur who does not have sufficient insurance policy.

Premiums for automobile insurance policy are affected by a wide range of variables, including the motorist's background, the kind of lorry, and regional guidelines. Understanding these fundamentals equips lorry owners to navigate the intricacies of their plans, ultimately bring about informed decisions that straighten with their unique requirements and conditions.

Examining Your Insurance Coverage Needs

When identifying the appropriate auto insurance coverage, it is essential to assess private conditions and threat variables. Recognizing your driving behaviors, the sort of car you have, and your monetary circumstance plays a considerable role in choosing the best policy.

Constant travelers or those that typically drive in high-traffic areas might need more detailed insurance coverage than periodic chauffeurs. Newer or high-value cars commonly profit from accident and comprehensive insurance coverage, while older cars might only call for obligation coverage.

In addition, your personal properties need to be considered. If you own considerable assets, greater obligation limits might be required to shield them in case of a crash. Reflect on your convenience degree with danger. Some individuals like to pay greater premiums for added satisfaction, while others may select marginal coverage to save money.

Comparing Insurance Policy Carriers

Next, consider the series of insurance coverage alternatives each company uses. Try to find policies that align with your specific needs, consisting of responsibility, crash, detailed, and uninsured motorist insurance coverage. Additionally, take a look at any type of available attachments, such as roadside help or rental automobile reimbursement, which can enhance your plan.

Pricing is an additional vital element. Acquire quotes from several service providers to understand the expense differences and the insurance coverage supplied at each rate point. Be mindful of the limits and deductibles linked with each policy, as these elements dramatically affect your out-of-pocket expenditures in case of a claim.

Last but not least, evaluate the claims process of each provider. An uncomplicated, efficient insurance claims treatment can considerably influence your general satisfaction with your car insurance policy experience.

Tips for Reducing Premiums

Several drivers are excited to locate ways to reduce their vehicle insurance coverage costs without giving up important insurance coverage. One reliable technique is to boost your insurance deductible. By opting for a higher deductible, you can dramatically reduce your monthly premium; nevertheless, make certain that you can comfortably afford the out-of-pocket cost in situation of an insurance claim.

An additional strategy is to make use of discounts provided by insurance firms. Several firms provide savings for elements such as risk-free driving records, bundling several policies, or having specific security functions in your automobile. When getting quotes., constantly make inquiries concerning readily available price cuts.

Keeping a great credit rating can additionally bring about reduced costs, as lots of insurance providers think about credit rating when figuring out rates. Frequently evaluating your credit scores report and resolving any type of inconsistencies can help improve your rating gradually.

Lastly, take into consideration the kind of car you drive. Vehicles that are cheaper to fix or have higher safety ratings frequently feature reduced insurance prices. By examining your vehicle selection and making informed choices, you can efficiently handle your auto insurance coverage expenses while making sure sufficient insurance coverage remains undamaged.

Evaluating and Upgrading Your Policy

Consistently examining and updating your automobile insurance plan is necessary to make sure that your coverage lines up with your existing needs and scenarios. auto insurance. Life changes, such as buying a brand-new vehicle, relocating to a various location, or modifications in your driving behaviors, can considerably influence your insurance demands

Begin by assessing your present insurance coverage limits and deductibles. You may want to change your crash and comprehensive protection appropriately if your automobile's worth has actually depreciated. Furthermore, think about any kind of brand-new read here price cuts you might receive, such as those for risk-free driving or packing plans.

It's additionally sensible my review here to evaluate your personal situation. As an example, if you have experienced considerable life occasions-- like marital relationship or the birth of a kid-- these may call for an upgrade to your policy. Furthermore, if you have adopted a remote job setup, your day-to-day commute might have transformed, potentially influencing your insurance requires.

Last but not least, consult your insurance policy copyright at the very least each year to go over any type of changes in rates or insurance coverage choices. By taking these positive steps, you can make certain that your automobile insurance plan gives the most effective protection for your evolving way of living.

Final Thought

Finally, picking the proper auto insurance policy plan requires a thorough understanding of insurance coverage types and mindful assessment of specific requirements. By comparing different insurance providers and actively looking for discount rates, policyholders can obtain a balance between adequate security and price. On a regular basis updating the plan and reviewing makes sure continued significance to transforming situations. Ultimately, an appropriate auto insurance coverage strategy offers to improve comfort, providing both monetary protection and confidence while navigating the roadways.

The most effective methods for customizing your automobile insurance policy strategy might not be instantly evident-- this i thought about this conversation will certainly reveal important insights that could transform your method to protection.

In the procedure of picking a vehicle insurance policy copyright, it is crucial to perform a detailed contrast to ensure you find the best insurance coverage for your requirements - auto insurance. By examining your car choice and making educated choices, you can efficiently manage your vehicle insurance policy costs while ensuring ample protection stays undamaged

In final thought, selecting the appropriate automobile insurance coverage plan calls for an extensive understanding of coverage kinds and careful analysis of private needs.